Overview

Tilaknagar Industries: Next Multibagger Stock

Established market position in the brandy segment of Indian manufactured foreign liquor (IMFL): TIL, which was set up as a sugar manufacturing company in 1933, gradually exited the same and started manufacturing and bottling of IMFL since 1974.Focused on premium segment that’s why have high margins.

The company enjoys a leadership position in the brandy segment (94% of total volume) in the IMFL industry, with a market share of nearly 25%, excluding Tamil Nadu. Further, within the prestige and above segment, TIL has around 30% market share. Brandy is the second largest in the spirits category, forming over 20% volume share after whiskey (55%). South India is a key region for IMFL manufacturers as it accounts for almost 60% consumption. TIL derives 86% of total volume from this region.Our market share in Andhra in December was almost 11.5%, 30% of our total volumes are driven by Andhra, Prestige and above constitutes only ~34% of overall brandy segment, which is much lower compared to whiskey and vodka. Increasing premiumisation is expected to augur well for the company as more than ~80% of its products are in the premium category. This along with new product launches is expected to drive revenue growth in the near-to-medium term.

With a strong foothold in the market, Tilaknagar Industries: Next Multibagger is poised to capitalize on the growing demand within the brandy segment.

Recently issues with the company-Mansion House Trademark dispute with Alliend Blender, which they won recently.Andhra Pradesh had recently announced privatisation of liquor retail outlets (effective October 2024), which lead to price fall, but in long term it will be beneficial as volume will increase.Normal margins 15-16% – Operating margin improved to around 16.9% in the first half of fiscal 2025, as compared to 12.9% in the corresponding period of the previous fiscal, driven by expansion in gross margin by around 150 basis points, subsidy of Rs 16 crore received from the government of Maharashtra, and benefits of higher operating leverage.

Increase in gross margin was driven by sharp correction in prices of key raw material, extra neutral alcohol (ENA). The margin should sustain at 15-16% over the near to medium term.Important – Margins include 1-1.5% subsidy benefit, Zero taxes due to carry forward losses. Now will give 25% taxes from Q1 or Q2 FY26.Financial leverage already played out as company became net debt free, but need to take loan again for IB acquisition.

Imperial Blue acquisition

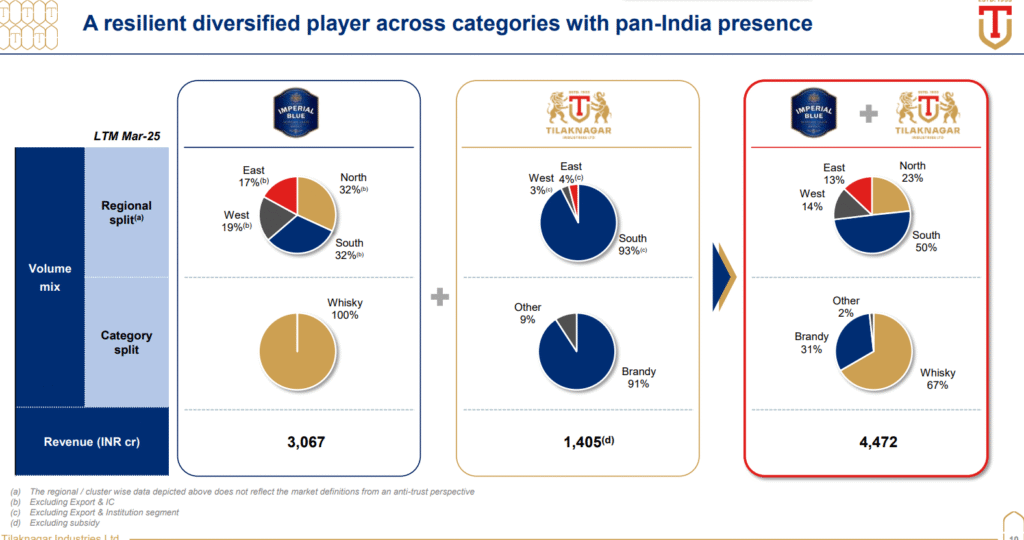

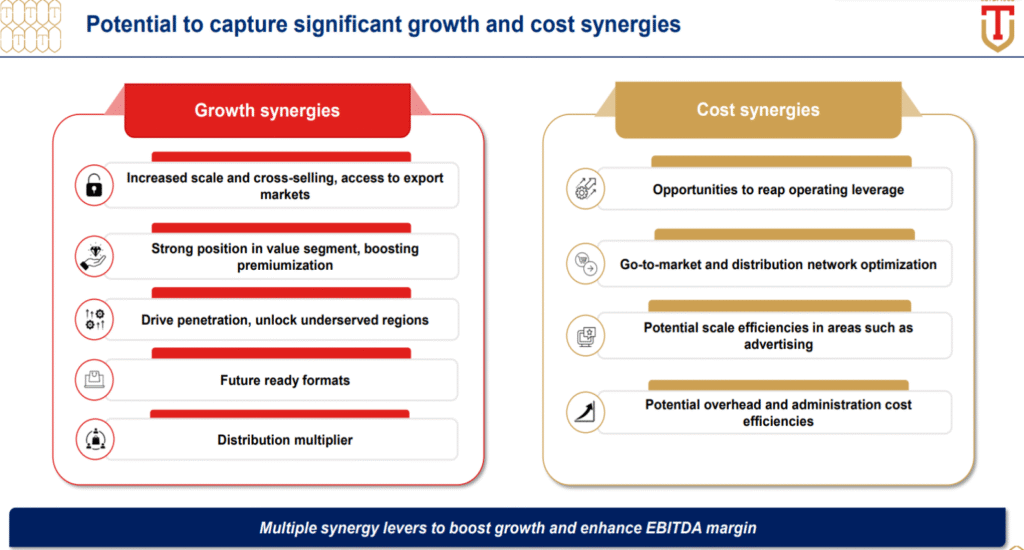

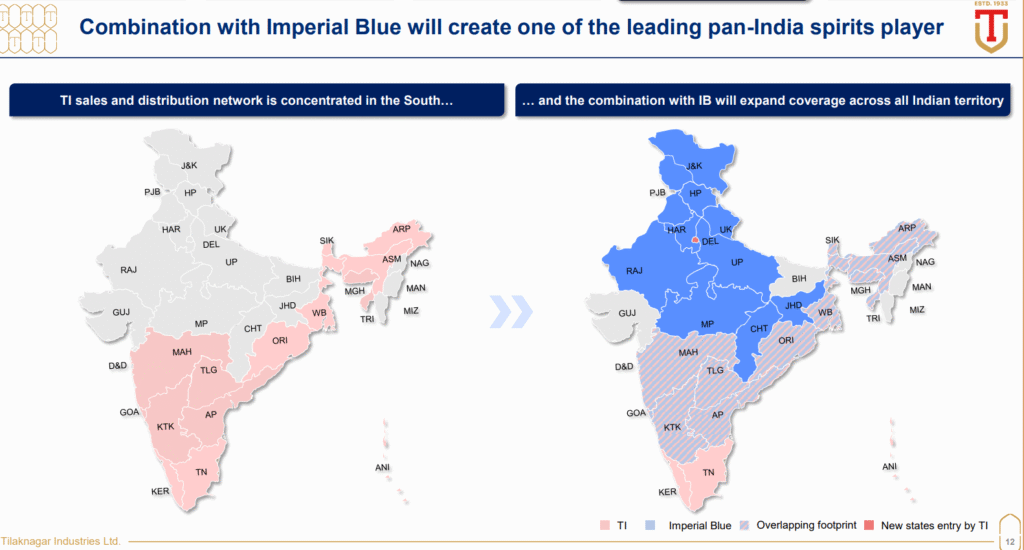

Geographical + Product diversification- After Imperial blue acquisition , they will become PAN India Player (Currently South india Focused) ,plus Whisky will have dominant share in their portfolio with 67% share going forward.

NOTE- Tilaknagar FY25 revenue- 1434 cr,whereas imperial blue’s FY25 revenue was 3067cr. IB has 9% market share in whisky category in india.Acquisition cost-4100cr, funded by equity and Debt.P/S of around 1.3x, looking lucrative wrt to peers.

Tilaknagar has been contract‑manufacturing for Pernod (Owned Imperial Blue brand) since FY21. They signed a 10‑year agreement on 1 Apr 2021 to bottle Pernod Ricard products at TI’s Maharashtra facility

MANAGMENT

Mr Amit Dahanukar, the current Chairman-cum-Managing Director joined the board in 2001.

RISK

Volatility in input prices and limited pricing power

: The key raw materials of TIL include ENA and glass (packing material). Profitability of IMFL manufacturers is dependent on price of ENA, as it forms 50% of raw material cost. ENA prices rose by nearly 20% from around Rs 59/litre in fiscal 2022 to around Rs 70/litre in fiscal 2023 and glass prices grew 20-30% in fiscal 2023 and softened in fiscal 2024. As a result, the operating margin declined from 14.7% in fiscal 2022 to 11.8% in fiscal 2023. However, margin has improved in fiscal 2024, partly due to softening of prices. ENA is derived from agro-based products such as grain and molasses, which are impacted by vagaries of monsoon; Note- Category and Geo concentration risk will go away after Imperial Blue (IB) acquisition.

Conclusion

Financial leverage and tax advantages already played out and rerating already doneNow tax rate will increase Have some corporate governance issues in the pastIB acquisition will lead to high debt+Equity dilution+ Consolidated margins will drag.Now it is upto the market that how much valuation it give.

Solid info