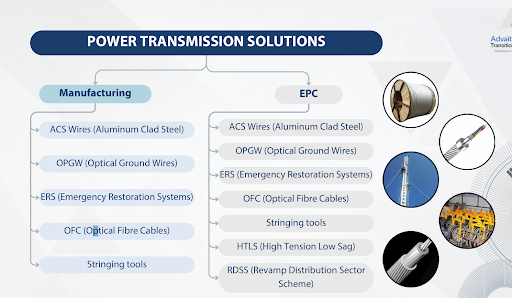

Advait Energy Transitions Ltd (AETL), founded in 2009, has evolved from providing power transmission solutions into one of India’s most promising players in green hydrogen, fuel cells, and battery energy storage systems (BESS). With strong Q1 FY26 results, a growing order book, and government-backed support through the PLI scheme, Advait Energy is positioning itself as a key enabler of India’s renewable energy future.

Q1 FY26 Results: Strong Momentum Across Segments

Revenue: ₹118.43 crore (up 11% YoY)

PAT (Profit After Tax): ₹9.69 crore, reflecting robust profitability

Order Book: ₹757 crore, up 82% YoY, driven by both Power Transmission Solutions (PTS – 66%) and New & Renewable Energy (NRE – 34%)

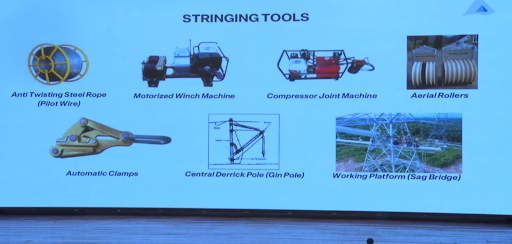

These numbers highlight sustained demand in OPGW, ERS systems, and renewable projects, showing that Advait is scaling across both traditional and new-age energy sectors.

Power Transmission Solutions: OPGW & ERS Driving Growth

OPGW Market Opportunity

- Optical Fibre Ground Wires (OPGW) remain AETL’s flagship product.

- Global OPGW market is valued at $580 million, with a CAGR of 4.8%.

- Every new transmission line requires OPGW, ensuring long-term demand visibility.

Emergency Restoration Systems (ERS)

- India and global markets face frequent disruptions in power transmission.

- Advait is among the few Indian players capable of designing and supplying ERS solutions, which restore electricity quickly after tower failures.

- Targeting expansion into Africa and CIS markets by 2030.

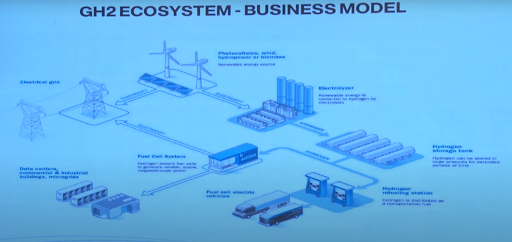

New & Renewable Energy: Betting Big on Green Hydrogen

Electrolyser Expansion

Awarded PLI approval for 200 MW Alkaline Electrolyser capacity, scaling to 300 MW by FY27.

Long-term plan: 1 GW capacity by 2030, aligning with India’s National Green Hydrogen Mission.

Fuel Cell & EPC Projects

- Completed India’s first micro-grid electrolyser + fuel cell project at THDC Rishikesh.

- Upcoming 1 MW hydrogen project with KPI Green Hydrogen Ltd, expected Feb 2025.

- Partnered with TECO 2030 (Norway) and GUOFU (China) for advanced hydrogen and fuel cell technology.

Solar & Battery Energy Storage Systems (BESS)

Secured a 40,000 solar pump order under the KUSUM scheme in Karnataka.

Entering large-scale BESS projects with bids for 50 MW and 100 MW IPP tenders.

Financial Overview: Profitability & Growth

H1 FY25 Revenue: ₹105.74 crore vs ₹75.22 crore YoY (40% growth)

EBITDA: ₹18.9 crore vs ₹11.96 crore (58% growth)

PAT: ₹11.4 crore vs ₹6.37 crore (79% growth)

Debt-Free Status: AETL remains net debt-free, giving financial flexibility for expansion.

Key Growth Triggers Ahead

- Hydrogen Electrolyser Demand: India’s electrolyser requirement expected to rise from 200 MW today to 8-9 GW in 3 years.

- PLI Scheme Benefits: Estimated ₹440 crore incentive inflows over FY26–30.

- Order Book Visibility: ₹476 crore unexecuted orders (Dec 2024), ensuring strong revenue flow.

- Investor Interest: Veteran investor Vijay Kedia picked up a ₹17 crore stake in June 2025, signaling strong confidence.

Risks to Watch

- Heavy dependence on government policies in hydrogen and renewables.

- Technological obsolescence risk due to reliance on overseas partners for electrolyser and fuel cell tech.

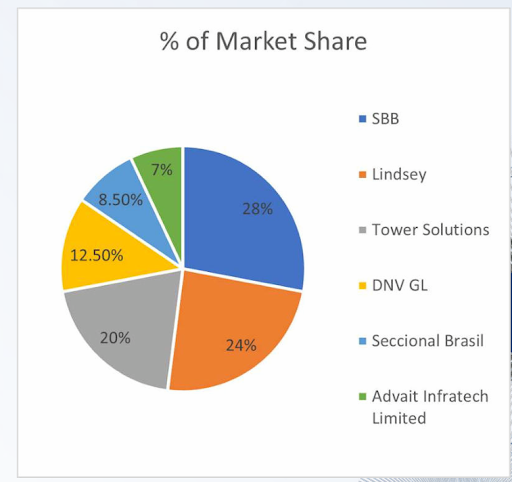

- Competition from global and SME players in EPC and solar projects.

- TECO 2030 bankruptcy raises concerns over fuel cell JV execution.

- Related party transactions and conflict of interest in OPGW JV.

Management & Vision

- Shalin Sheth (MD): Mechanical engineer with experience at Adani Power & Kalpataru Power.

- Focused on scaling PTS, building electrolyser manufacturing, and expanding renewable portfolio.

- Vision: Achieve ₹3,000 crore revenues by 2030 (₹1,000 crore Power Transmission + ₹2,000 crore Renewable Energy).

Conclusion: Advait Energy as a Sunrise Sector Stock

Advait Energy Transitions is at the cusp of India’s power infrastructure and green hydrogen revolution. With a strong order book, government incentives, and clear growth roadmap, it has the potential to become a ₹3,000 crore leader by 2030.

However, risks around competition, technological dependence, and execution must be monitored closely. For investors seeking exposure to Green Hydrogen, Electrolyser Manufacturing, and Power Transmission, AETL remains a high-risk, high-reward sunrise sector opportunity.

FAQs

- Q1: Is Advait Energy Transitions a good investment for 2025?

Advait Energy has shown strong growth with rising order book and entry into green hydrogen, but risks around competition and execution exist. - Q2: What is Advait Energy’s electrolyser capacity plan?

The company plans to commission 300 MW by FY27 and expand to 1 GW by 2030. - Q3: Who are Advait Energy’s technology partners?

AETL has tie-ups with GUOFU (China) for electrolysers and TECO 2030 (Norway) for fuel cells. - Q4: What is Advait Energy’s 2030 revenue target?

The management aims for ₹1,000 crore in Power Transmission and ₹2,000 crore in Renewable Energy divisions by 2030.